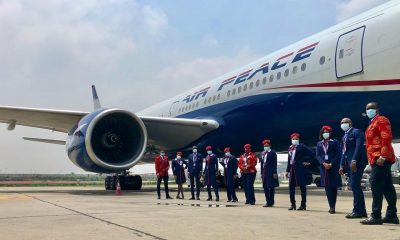

Africa is emerging as a preferred global destination for travellers, driven by a thriving tourism and business sector. The continent’s aviation landscape is now a formidable force, fostering crucial connections between Africa and the global community.

Recently, Skytrax, a renowned international airline assessment organization, revealed its 2023 report on the Best Airports in Africa. South Africa dominated the regional ranking, with additional entries from Kenya, Morocco, Rwanda, and Mauritius.

1. Cape Town International Airport, South Africa

This is a premier international hub with modern infrastructure and a commitment to eco-friendly practices. The airport hosts 4.13 passengers per 10 square meters daily, catering to a discerning crowd.

2. King Shaka International Airport, South Africa

Located in Durban, it stands as a beacon of excellence among Africa’s best international airports. The terminal, covering 102,000 m2, can handle 7.5 million passengers annually.

3. Johannesburg International Airport, South Africa

Serving as the primary hub for domestic and international travel in South Africa. Since 2020, Africa’s fifth busiest airport with a capacity for 28 million passengers per year.

4. Casablanca International Airport, Morocco

Handled about 7.6 million passengers in 2022, ranking among the top 10 busiest airports in Africa. A hub for Royal Air Maroc, Royal Air Maroc Express, and Air Arabia Maroc.

5. Mauritius International Airport

A strategic gateway with direct flights to Africa, Asia, Australia, and Europe. Renowned for its commitment to passenger satisfaction and prime location.

6. Marrakech International Airport, Morocco

An international facility connecting Europe, the Arab world, and soon North America. Terminals designed to handle 2,500,000 passengers annually.

7. Addis Ababa International Airport, Ethiopia

Formerly Haile Selassie I International Airport, it’s the main hub for Ethiopian Airlines. Links Ethiopia and Africa to Asia, Europe, North America, and South America.

8. Kigali International Airport, Rwanda

Serving Kigali and playing a vital role in connecting Congolese, Burundian, and Ugandan cities. The terminal accommodates 1.5 million passengers annually.

9. Nairobi International Airport, Kenya

A key connection point to East African destinations, quadrupling its capacity to host 26.5 million passengers yearly.

10. Bloemfontein International Airport, South Africa

Formerly Bloemfontein International Airport, now Bram Fischer International Airport. An economic hub hosting over 300,000 passengers and 17,000 air traffic movements annually.

Source: africanews

diplomacy4 semaines ago

diplomacy4 semaines ago

News3 semaines ago

News3 semaines ago

News3 semaines ago

News3 semaines ago

News2 semaines ago

News2 semaines ago

Features1 semaine ago

Features1 semaine ago

Entertainment1 jour ago

Entertainment1 jour ago